Functions Of Mutual Funds

One of the most commonly asked questions about Functions Of Mutual Funds is what are their functions? A mutual fund is a portfolio of securities that are traded and owned by an investor. When asked what are mutual funds functions, the answer to this question could be anything from earning a profit for investors through the use of dividends to creating money for investments by individuals or companies and then using the money for investments themselves.

The first function of mutual funds is to create new investments that will earn income to meet expenses. For example, if a mutual fund is created to invest in real estate, it will purchase properties that are considered either good or bad. The goal of the mutual fund manager is to earn the highest return on the property. Once an investment starts to earn interest, it can be sold to generate income.

Functions Of Mutual Funds can be diversified. This means that different parts of the portfolio will be invested in different areas. An investor can also choose mutual funds that specialize in particular investments. This means that some mutual fund investment will focus on assets such as stocks, bonds, real estate, commodities, and others.

Diversification is another mutual fund function. It refers to the idea that all of the investments that make up the portfolio are chosen to have similar overall results. This means that no single asset will dominate. This is a function of market liquidity. The liquidity of a mutual fund is how well the investor can liquidate his holdings.

A final mutual fund function is efficiency. The effectiveness of the fund is measured by how well it matches an investor's expectations. If it does not, then the fund is ineffective. Many mutual funds are designed so that the manager can successfully match the expectations of the investor. This allows investors to have a good experience with their fund.

The functions of mutual funds are essential for investors who are looking to make reliable profit. These functions allow them to enjoy their investments while also having a high rate of success. However, a good fund must be matched with an investor who has the same expectations. This way, the two parties' expectations will match so that there will be a good experience.

All of the functions of mutual funds should be examined closely by a knowledgeable person. This will ensure that a potential investor is able to have the best experience possible with a mutual fund. The key functions are important because they allow investors to see what they are investing in and at the same time allow a person to evaluate it based on its performance. This evaluation is done before the investment is made and will be reviewed periodically thereafter. A mutual fund is an investment vehicle that allows investors to do several functions, each of which is important to a specific individual.

One of the most important Functions Of Mutual Funds is to provide income. All of the capital investment goes towards providing this income to investors. There are various ways in which this can be achieved and one of them is through dividends. Dividends are payments madeperiodically to investors that are based on the value of the fund. When a mutual fund is active, it is likely to have a constant or steady income that will depend on the performance of the investment.

Another function of mutual funds is as a source of growth. The amount invested will depend on the expectations of the investors. If the growth expectation of the fund is low, more money will go towards paying off interests. However, if growth expectations are high, more money will go towards investments to earn profits. This is one of the main functions of mutual funds and it allows them to adapt to changes in the market.

Investment management is also a key function of mutual funds. This involves the identification, evaluation, and the allocation of assets between various projects. The management also determines when to sell some of the investments and when to buy some of them. This is required for the investor to ensure that his investments are maximized and his gains are not lost.

Advantages -

- Advanced Portfolio Management.

- Dividend Reinvestment.

- Risk Reduction.

- Convenience and Fair Pricing

- High Expense Ratios and Earnings Charges.

- Direction Abuses.

- Tax Inefficiency.

- Poor Trade Execution.

Mutual Fund Risk And Functions Of Mutual Funds

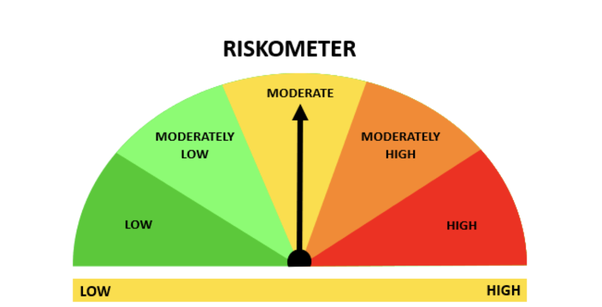

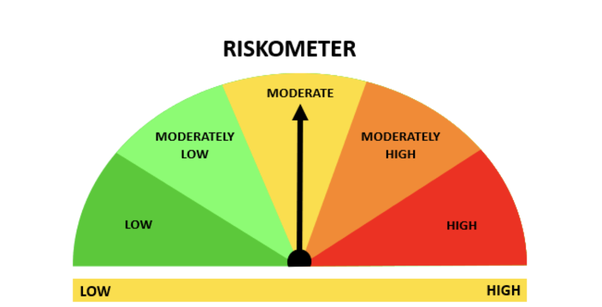

Functions Of Mutual Funds investment is based on the concept of collective v or the risk level of a group of securities or assets. Fund managers seek to provide investors with a combination of investments that will meet their investment goals. In order for investors to be successful, fund managers must select investments that will produce the results the investor is seeking. To achieve this, fund managers may take into consideration several factors before making a final decision regarding the selected investments. The key v factor is the rate of return on the invested principal. While some funds have a higher risk factor than others due to the risks inherent in the investment environment, they can also provide a steady rate of returns.

Other factors affecting risk involve the marketability of the mutual funds. Marketability refers to whether or not the securities held within the fund are transferable. Transferable securities are more exposed to risks as there are times that the securities held within the fund may not be in the hands of an interested investor. Additionally, during periods when economies are doing well, it may be more difficult for investors to sell their mutual funds due to high demand.

A third mutual fund risk that affects fund risk is the rate of change in portfolio holdings. Within the fund, there are several possible changes that occur. One such change is the portfolio turnover. This refers to how often investors in a mutual fund change their positions. Another is the rate of portfolio investment growth. While portfolio growth can increase overall asset value, it can also increase mutual fund risk in the form of higher loss throughout any one period of time.

All three risk factors are considered and managed by individual fund managers. Managers can utilize all risk management techniques. Some of the commonly used risk management techniques are beta analysis, price analysis, and other statistical techniques to identify areas of mutual fund risk and create a strategy to reduce that risk.

Many new investors do not realize that many fund managers are mere stock pickers. The fund manager identifies potential funds based on their methodology. If that methodology

underperform the market then the fund manager can make a recommendation to invest in that manager's fund. If that recommendation is successful, the fund grows. If it fails, the fund manager suffers a major loss.

A good way to understand the complexity of mutual fund risk management is to consider the following example. Assume that a mutual fund were to lose fifty percent of its value in a one month period. This would translate into one bad month out of four that the fund lost half its value. This is considered very bad risk on the scale of mutual fund risk.

Now assume that this same fund manager was able to convince his stock picker to invest the fund with him. This same fund manager would have to convince five different stock brokers that his pick was the right one for their clients. If he did so, his profit from the sale would offset the losses from his own investment. This would ensure that he actually made money on the fund even though his own portfolio lost money.

In conclusion, there are two types of risk associated with mutual fund risk. One type is inherent in the risk inherent in the entire portfolio, while the other type is created by the choices of the individual fund manager. Every fund is subject to certain risk characteristics.

Managers can reduce that risk by implementing effective risk management techniques and only investing inthose funds that are clearly safer than the index funds they are invested in. While the typical investor does not control the investment strategies of the fund manager, he or she does control their compensation and can influence whether the fund manager is truly a risk taker or a "scorched earth" practitioner who cares more about generating a high share price per share than generating a high return on his or her investment.

Facts About Mutual Funds

Facts about mutual funds are important for investors who are just getting started investing in the market. The most common type of mutual fund is the mutual fund. A mutual fund is usually an investment fund that pools cash from a number of investors to buy securities. Generally, mutual funds are also "the largest percentage of total equity of U.S. companies." The main function of mutual funds is to pool investments and generate a profit for its investors. The earning potential of a mutual fund can be extremely profitable, but it all depends on the individual investor.

Facts about mutual funds usually include what they are, how they work and why you would want to use them. Basically, there are three types of mutual funds. In addition to the basic categories described above, there are also investment grade and risk-managed funds. Investment grade mutual funds trade with a specific goal in mind - increasing the net cash value (NVR) of the portfolio. Risk-managed funds are designed to reduce the risk of loss and are ideal for families and retirement funds.

Facts about mutual funds usually include what they involve and how they work. Essentially, a mutual fund consists of a basket of securities or investments that are bought and sold according to the direction of the fund manager. Fund managers use a variety of strategies to increase the profitability of mutual fund portfolios. For example, some managers will use short selling to reduce risks associated with an investment portfolio. Other strategies include diversification to try to offset the risk associated with any one particular security and using stop losses to protect against excessive loss of investment.

Facts about mutual funds may also include the types of risks they offer to investors. Typically, the best way to manage mutual funds is by using a combination of strategies. An investor should educate themselves on the varying strategies for each type of fund uses and what effect those strategies may have on the overall performance of the portfolio. A mutual fund can be very profitable if used in the right way and managed properly, but an investor can still lose money if they don't use the information the fund provides them with when making their investment decisions.

There are a few ways that an investor can lose money in mutual funds. First, they can buy too many or too little. Any mutual fund contains a set amount of stock or other assets that a particular manager thinks will be profitable over time. Investors who don't take the time to learn about how the various components of a mutual fund are constructed can end up with an investment that losing far more money than it is worth.

Secondly, an investor may buy a fund that is much too large or too small. This can have a

significant effect on the way their mutual fund makes money. Large mutual funds often pay high dividends because of the large amount of money that has been invested; however, this also attracts investors who wish to make a large profit quickly.

Final Verdict

Finally, investors must learn about the history and performance of mutual funds. When an investor purchases a Functions Of Mutual Funds they are buying part of a large portfolio of stocks or other assets. If the fund does not make money for years, then the investor usually has nothing to show for their investment. Historical performance is critical to the success of any mutual fund. It is important for investors to become familiar with how the fund has performed during various periods in history and how it is doing now.

Facts about mutual funds are important to any investor. However, without learning about the various components of the fund and how they affect the overall performance of the fund, an investor is likely to lose money on their investment. Learning as much as possible about mutual funds is the best way to avoid making costly mistakes. It can also help to build a solid record of successful fund investments.

0 Comments