Reviews Of Bond Risk

Experienced traders understand the significance of diversification. Mixing your portfolio with distinct asset classes is most likely the ideal approach to create consistent returns--currencies, stocks, derivatives, commodities, and bond Risk. Though bonds might not always supply the greatest yields, they're considered a rather reliable investment instrument. That is as they're proven to offer regular income. However, they're also regarded as a secure and sound approach to spend your cash because--especially those provided by the authorities --are ensured.

KEY TAKEAWAYS

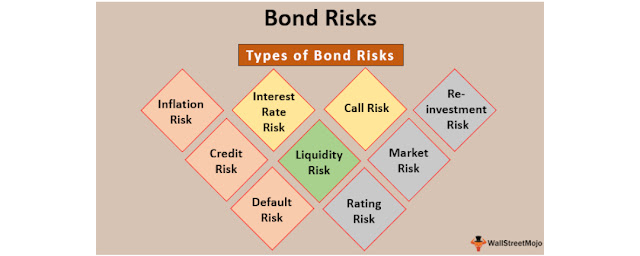

Though bonds are thought to be secure, there are drawbacks for example interest rate risk--one of the principal risks related to the Bond Risk industry.

Reinvestment threat usually means a bond or prospective cash flows need to be reinvested at a safety with a lower return.

Callable bonds have provisions that enable the Bond Risk issuer to buy the Bond Risk back and retire the problem when interest rates drop.

Default danger occurs when the issuer can not cover the interest or principal in a timely fashion or at all.

Inflation risk occurs when the speed of cost increases in the market deteriorates the yields related to the bond.

Principles of Bond Risk Investing

organization or government which wishes to raise some money. So once you purchase a bond, you are committing the Bond Risk issuer cash. In exchange, the issuer promises to repay the main amount for you by a particular date and sweetens the pot by simply paying you attention at regular periods --typically semi-annually.

This usually means you've got to purchase themespecially corporate bonds--via a broker. Remember, you might need to pay a premium based on the agent you select. If you are trying to purchase federal government bonds such as U.S. Treasury Securities, you can do this directly through the authorities. You might even put money into a Bond Risk fund that's a debt fund which invests primarily in several kinds of debts such as corporate, government, and municipal bonds, in addition to other debt instruments.

Interest Rate Risk Bond Risk

So once you purchase a bond, you dedicate to getting a predetermined speed of yield (ROR) for a specified period. If the industry rate increase from the date of this Bond Risk purchase, its cost will fall so. The bond will then trade in a reduction to signify the decrease yield an investor will create on the bond.

The reverse relationship between market interest rates and bond costs holds true under decreasing interest-rate surroundings too. The initially issued bond could sell in a premium above level value since the voucher payments connected with this bond could be higher than the voucher payments provided on recently issued bonds. As you can infer, the association between the purchase price of a bond and market interest rates is only explained by the supply and need for a bond at a shifting interest-rate atmosphere.

Market interest rates are a function of many things such as the supply and demand for cash from the market, the inflation speed , the point the business cycle remains in, along with also the government's fiscal and monetary policies.

Say you purchased a 5 percent voucher, a 10-year company bond that's selling at level value of their $1,000. If interest rates leap to 6 percent, the market value of this bond will fall under $1,000 since the 5 percent fixed interest it pays develops less appealing as recently issued bonds will yield a complete percentage point greater for bondholders. Because of this, the initial bond will trade at a discount so as to compensate for this gap.

Interest rate risk can be rather simple to comprehend concerning demand and supply. Now, let us determine what would occur if market interest rates rose by one percentage point. Under this situation, a recently issued bond with similar features as the initially issued bond could cover a voucher amount of 6 percent, supposing it is provided by par value.

Because of this, the issuer of the bond could find it challenging to locate a buyer willing to pay level value due to their bond beneath an increasing interest rate environment as a buyer could buy a recently issued bond from the marketplace that pays a higher coupon sum.

As a result of this, the bond would need to market it at a discount from par value to be able to entice a buyer. The reduction on the purchase price of the bond are the quantity which would earn a buyer indifferent concerning buying the first bond with a 5% voucher sum, or the recently issued bond having a more positive coupon speed.

Reinvestment Bond Risk

Another risk related to the bond market is known as reinvestment threat . Essentially, a bond introduces a reinvestment risk to investors if the proceeds from the bond or prospective cash flows need to be reinvested at a safety with a lower return than the bond initially supplied. Reinvestment risk may also arrive with callable bonds--investments which may be called by the issuer prior to the maturity speed.

By way of instance, imagine an investor purchases a $1,000 bond with an yearly coupon of 12 percent. But imagine that, as time passes, the industry rate drops to 1 percent. Suddenly, that $120 obtained from the bond could only be reinvested at 1 percent, rather than the 12% rate of the bond.

The other threat is that a Bond Risk is being predicted by its own bureaucracy. Callable bonds have telephone provisions which permit the Bond Risk issuer to buy the bond back from the bondholders and retire the matter. This is normally achieved when interest levels fall considerably because the issue date. Call provisions permit the issuer to retire the aged, high-rate bonds and market low-rate bonds in a bid to reduce debt costs.

Default Bond Risk

This provides investors an notion of how probable it is that a payment default will happen. If the Bond Risk issuer defaults, then the investor loses a part or all their initial investment and any interest they might have earned.

By way of instance, most national authorities have very large charge evaluations (AAA). They have the capacity to cover their debts by increasing taxation or printing, so making default option. In such scenarios, bondholders will probably lose all or nearly all of their investments.1

Inflation Bond Risk

This risk refers to situations once the rate of cost increases from the market deteriorates the yields related to the bond.

By way of instance, if an investor buys a 5 percent fixed bond, and inflation climbs to 10 percent each year, the bondholder will eliminate money on the investment since the buying power of their profits has been drastically diminished.

0 Comments